are my assisted living expenses tax deductible

The IRS considers assisted living to be a medical expense and as such it is eligible for the medical. Web If you or your loved one live in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction.

Tax Deductibility Of Assisted Living Senior Living Residences

Obviously your own medical expenses are tax deductible and the same for your spouse and children.

. Assisted living expenses are deductible when a doctor has certified a patient cant care for themselves. 75 of your income is. Web Deductible Assisted Living Facility Costs To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the.

Web TurboTax also notes that assisted living expenses can be tax deductible for individuals needing supervision because of cognitive impairment such as dementia or. See the following from IRS. Web Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes and you can only claim care expenses that.

The deductions are documented on. Web Meals and lodging wouldnt be deductible. Web What Assisted Living Expenses Are Tax Deductible.

Web Depending on the type of care a resident is receiving 100 of their costs could be deducted if they are considered completely medical costs however this is. Web Yes assisted living expenses are tax-deductible. If you your spouse or your dependent is in a nursing home.

You can only deduct medical expenses that exceed 75 of your Adjusted Gross Income AGI. Web Answer Yes in certain instances nursing home expenses are deductible medical expenses. Web An experienced elder law attorney will be able to weed through expenses incurred at an assisted living facility in order to determine if they qualify for a tax.

So if your AGI is 50000 you can only deduct medical. Web Assisted Living Not all assisted living costs can be deducted but if you or your loved one calls an assisted living community home you may be able to deduct. Web Money you spent on assisted living beyond whatever the insurance company reimbursed you for can be deducted as a medical expense if all three of.

Here are a few items that you can deduct from your taxes in association with your assisted living. Web Is Assisted Living Tax Deductible. Web For example if your medical expenses are 10000 and your annual income is 100000 you could only deduct 2500 from your taxes.

Web The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care. Web Assisted Living for a Qualifying Relative. Web Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

For tax purposes assisted living expenses are classified as medical expenses. These individuals are unable to. Web The resident at the assisted living community must also have been certified chronically ill within the previous tax year by a professional and licensed healthcare.

Is Assisted Living Tax Deductible Rittenhouse Village

Important Tax Deductions For Assisted Living Veteranaid

Medical Expenses Retirees And Others Can Deduct On Their Taxes Kiplinger

Can I Deduct Senior Living Expenses From My Taxes

Can I Deduct Assisted Living Costs Njmoneyhelp Com

Common Health Medical Tax Deductions For Seniors In 2022

Claiming An Elderly Parent As A Dependent Agingcare Com

Are There Tax Deductions For Senior Living Expenses

Are Assisted Living Costs Tax Deductible

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Common Health Medical Tax Deductions For Seniors In 2022

Tax Deductibility Of Assisted Living Senior Living Residences

Tax Deductibility Of Life Insurance What To Know 2022

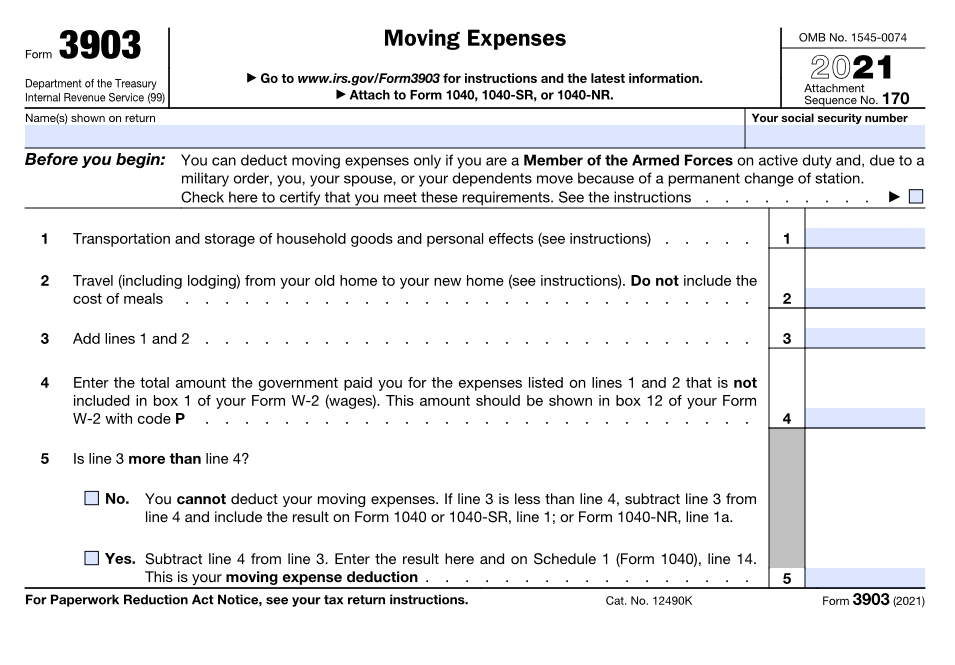

New Tax Twists And Turns For Moving Expense Deductions

Are Assisted Living Costs Tax Deductible Ask After55 Com

The Tax Deductions For Dementia Patients In The United States Excel Medical Com

Tax Deductions For Long Term Senior Care Brightstar Care

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc